Why road tax prices are different in each state in Malaysia

Road Tax prices change from one state to another, which makes many people confused about why they changed and what factors that influence this tax variation are. The continuously changing road tax rates have created curiosity in many people. This article will lead you to the answer to why road tax prices vary across different states in Malaysia.

Here is a list of various factors which influences price variations in Malaysia.

Road Infrastructure and Maintenance Costs

One of the main factors that contribute to the variations in road tax prices is the difference in road infrastructure and maintenance costs between different states. States with extensive road networks and high maintenance requirements may increase road tax rates to fund ongoing repairs, upgrades, and maintenance activities, while states with more normal infrastructure needs may charge lower road tax rates.

Engine Capacity Takes Center Stage

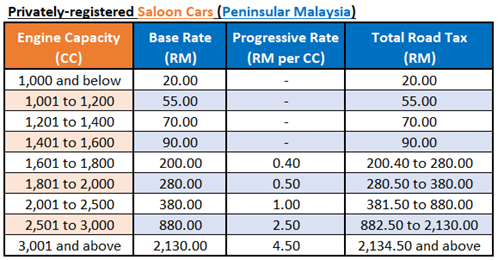

The tax rates and prices may vary depending on the engine capacity. It starts from 1000cc to 3100cc. The basic price for the 1000cc starts from 20RM and the last price for 3100cc may be different depending on the location and body type of the vehicle.

Vehicle Population and Traffic Density

In Malaysia, tax rates also depend on the vehicle population and traffic density. The more costly vehicle you are using there are chance of high rates.

Traffic density also plays an important role in road tax rates price. The more traffic density more will be the road tax price.

Local Policies and Governance

Malaysia is divided into different regions. Local bodies also make their own policies apart from the Government. Local bodies are allowed to make rules according to their customs, and incidents.

Local policies also play an important role in the road tax rates in Malaysian states.

East vs. West: A Tale of Two Tariffs:

East Malaysia is advanced and has well network of roads. That’s why the rates prices is higher in Eas as compared to West Malaysia. The prices may vary from one region to another.

The tax prices do not depend on the origin of the vehicle. It depends on the running area of the vehicle. Let’s suppose you are from Sarawk area and you are working in the Peninsular then the road tax will cost according to the rule of the Peninsular area. It may be too much confusing sometimes.

Note: Because of too many complications we have designed a road tax calculator in Malaysia. You can use it to calculate road tax in your daily life.

Environmental Initiatives:

Some times Government of Malaysia takes some initiatives to make the environment clean. So they may implement some extra taxes so people avoid running too many cars. If they run it then they have to may tax. These steps are taken to minimize the use of personal vehciles. It pointed people to use local transports so the environment could become clean and user friendly.

Conclusion

While a single set of road tax rates across Malaysia might seem simpler, the current system acknowledges regional variations in infrastructure and economic realities. Ultimately, understanding the rationale behind these discrepancies empowers you to plan your budget accordingly and enjoy the freedom of the open road, Malaysian style. Remember, knowledge is power, and when it comes to road tax, knowing your state’s tariff can save you a few ringgit!

By understanding the interplay of engine capacity, geography, and other factors, you can demystify the different road tax rates in Malaysia. So, the next time you renew your road tax, remember – it’s not just about your engine purring, it’s about the unique story of the road beneath your wheels.tunesharemore_vertadd_photo_alternate