Road Tax Motor

The owner of a motorcycle which is also called Motosikal in Malaysia has to pay road tax. It is formally known as Lesen Kenderaan Motor (LKM). It is an annual fee that allows you to legally operate your motorcycle on Malaysian roads. This article explains things you need to know about road tax for motorcycles in Malaysia.

Factors Affecting Road Tax Motor Costs

The cost of your Road Tax Motor is primarily determined by two factors:

Motorcycles with larger engines (higher cubic capacity or “cc”) incur higher road tax motor fees. The logic is that larger engines are associated with more powerful bikes that may put more wear and tear on the roads. Because of this reason road tax prices are kept highter.

Road tax is slightly cheaper in East Malaysia (Sabah and Sarawak), Labuan, Langkawi, and Pangkor compared to Peninsular Malaysia.

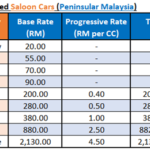

Motorcycle Road Tax Rates

The basic Road Tax Motor rate starts from a base rate of RM2. Moreover, prices progressively increase based on engine size. Fixed flat rates apply up to 1600cc for cars, ranging from RM20 to RM90. Beyond this threshold, progressive rates kick in.

Harga Roadtax Motor Table in Malaysia

| Cubic Capacity (cc) | Base Rate |

| 150 and below | RM2.00 |

| 151 to 200 | RM30.00 |

| 201 to 250 | RM50.00 |

| 251 to 500 | RM100.00 |

| 501 to 800 | RM250.00 |

| 801 and above | RM350.00 |

Renewal Process

You can renew your motor road tax through several channels. Here are list of methods which you can use.

Does the price change?

Your road tax price usually stays the same every year if your bike’s the same. It can cost a little more depending on where is your renewal location. There may be extra fees some places charge.

For example, renewing at the post office or JPJ counter adds an extra RM2 fee.

Here’s an example:

Saving money on fees

You can skip the extra fees by renewing your road tax online with websites like Bjak. This saves you from going somewhere in person and waiting in line. Plus, you can renew your motorcycle insurance at the same time and choose a physical or digital copy of your road tax.

How long can you renew for?

You can renew your road tax for 6 months or a whole year. Sometimes you HAVE to renew for only 6 months, like: