Road Tax Calculator in Singapore

Road tax is a tax you should have to pay to the government for using public roads. In Singapore, road tax is also applied to road vehicles. This tax is used to improve roads in Singapore and other traffic rules. Being an owner it is necessary to pay road tax so you do not face any hurdle while driving a vehicle in Singapore. This road tax helps the government make good transportation infrastructure.

In this article, we will discuss complete details about road tax in Singapore how it is applicable, and how we can calculate it. all the details for road tax are given below.

Read More:Road Tax Delivery Status

How the Road Tax System Works in Singapore

In Singapore, you have to pay road tax for 6 or 12 months. when you pay road tax you should receive the tax receipt for the proof. After 6 or 12 months before your tax period is over you will receive a notification to renew your tax before the the end of your paid tax period. This process will continue until you own a vehicle in Singapore.

How TO Calculate Road Tax In Singapore

Road tax is applied to all vehicles which use public roads. He we discuss some factors for road tax calculations;

There are three types of factors that affect road tax payable in Singapore

If your vehicle age is more than 10 years you have to pay more surcharge of 10 to 15% of your road tax.

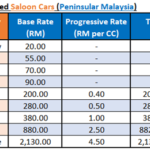

The road tax also depends on the engine capacity of vehicles. larger the engine capacity your road tax will be higher.

Road tax is different for diesel vehicles and petrol engine vehicles. If you own diesel vehicles you have to pay $$1.25for per cubic meter and for petrol vehicles, it decreases to $$0.40.

We have given some calculations for road tax in Singapore so that you can easily understand what your road tax can be

| Vehicles age | Yearly Road Tax Surcharge |

| >10 year | 10% of road tax |

| >11 year | 20% of road tax |

| >12 year | 30% of road tax |

| >13 year | 40% of road tax |

| >14 year | 50% of road tax |

| Engine Capacity | Road Tax For 6 Month |

| EC < 600 | $156.4 |

| 600 < EC < 1,000 | S$156.4~S$195.5 or [S$200 + S$0.125(EC – 600)] x 0.782 |

| 1,000 < EC < 1,600 | S$195.8~S$371.5 or [S$250 + S$0.375(EC – 1,000)] x 0.782 |

| 1,600 < EC < 3,000 | S$372~S$1,192.6 or [S$475 + S$0.75(EC – 1,600)] x 0.782 |

| EC > 3,000 | >S$1,193.3 or [S$1,525 + S$1(EC – 3000)] x 0.782 |

How Long Road Tax Is Valid

In Singapore road tax is calculated for 6 to 12 months. Mostly it’s calculated for 12 months however if you pay for 6 months that rate will be simply halved. so better if you pay 12 months of your road tax so you can enjoy driving for 12 months without any hesitations.

How To Renew Road Tax

Road tax in Singapore can be renewed in Singapore for every 6 to 12 months. You will be notified by government authorities LTA for the due dates for renewing tax when your last paid tax period is about to end.

What You Need For Tax Renewal

LTA requires you to have the following prerequisites so that you can renew your road tax in Singapore.

According to LTA rules your vehicle is insured for that period. if your vehicle insurance is 15 months then you can pay tax for more than 12 months but if it’s less than 12 months you can pay for the same 12-month of period.

When you renew your road tax the LTA requires your vehicle inspection also. If you received your vehicle inspection notice just before one month of renewal of road tax you have to complete your vehicle inspection before paying road tax. Make sure when you are paying tax you carry all clear reports for that.

When you pay road tax you should be aware that all your dues and fines are cleared. there should be no dues or fines remaining related to LTA, Housing and Development Board, Traffic Police, or Urban Redevelopment Agency. It is recommended that you check from all authorities if some dues are remaining so you clear it before paying road tax.

How To Pay Road Tax In Singapore

Vehicle owners can pay tax in Singapore in the following ways;

You can pay your vehicle road tax directly at the center of the collection by visiting the nearest centers. To do that just carry your original documents and can pay your tax on the spot and can get your receipt for tax on the spot.

If you are worry of filling out forms you can pay your tax through Axs station by visiting the nearest Axs machines. For this, you can use your ATM or credit card to pay taxes easily. Axs station also has internet banking facilities.

If you want your road tax to be deducted directly from your GIRO account you have to fill application for that just before 1 month tax renewal deadline.LTA takes time to process your request but you should not worry your tax will be renewed before the tax deadline.

You can pay your tax online at OneMotoring, it requires a valid debit card visa card, or internet banking account with Citibank, charted bank, or UOB. Remember you have a payable amount available in your account. It takes three to four working days to receive your Road tax.

In this article, we have concluded how we can calculate the road tax in Singapore. also, we concluded which factors depend and how we can renew road tax and what the methods are to pay road tax in Singapore.