How To Check No Claim Discount NCD Online

NCD online is known as the No Claim Discount. It is the discount given by insurance companies in Malaysia for vehicle insurance and is a reward or incentive for vehicle owners

This insurance however has some conditions. This discount is given to vehicle owners in certain situations we have discussed below;

Read More: Malaysia Tax calculator

Required Documents to check NCD Online

Here is list of documents which are required to check NCD.

How to check your NCD

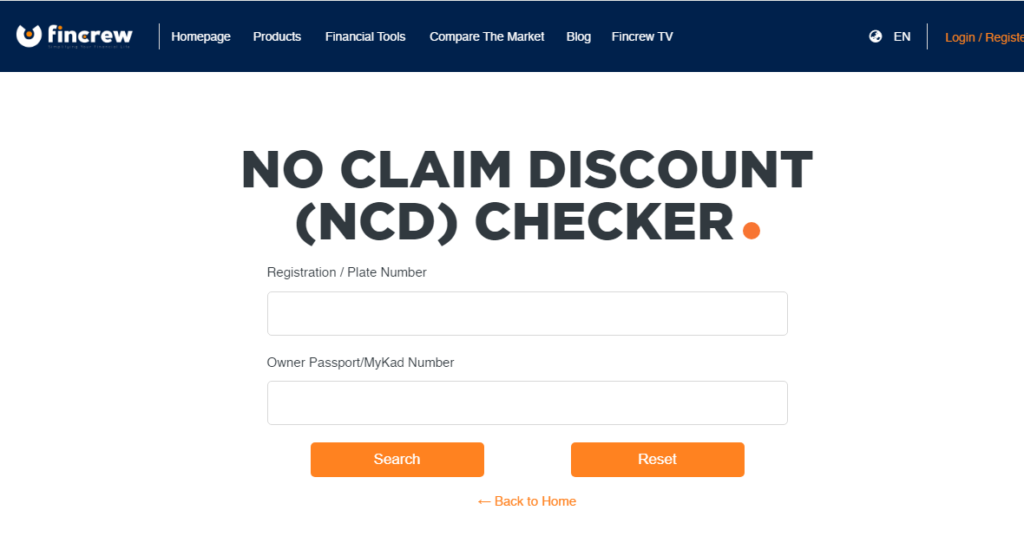

You can easily check your NCD using fincrew website. Here is simple way how you can do it.

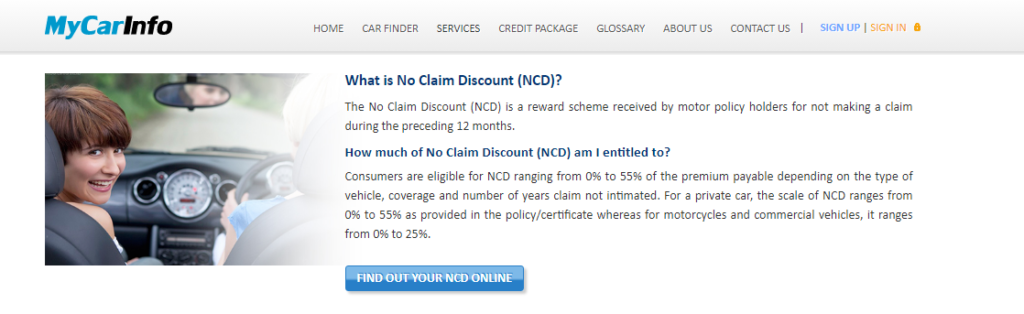

The MyCarInfo Online Portal

Here is simple method you can use to check your NCD Online.

Contact Your Insurance Company Directly

Using Fincrew

However, we have given complete details about the NCD rate for vehicles in Malaysia so you can easily understand.

NCD Rates For Vehicles

NCD rates for vehicles in Malaysia are set by (PIAM) Persatuan Insurance am Malaysia.

Every insurance company in Malaysia follows it.NCD rates for new vehicles usually start from zero but increase over time.

NCD rates for private cars, motorcycles, and commercial vehicles are different we have given complete details about that below;

NCD Rates For Private Cars

NCD Rates for private cars in Malaysia are given in detail the owner can easily understand NCD rates with this

1st Year

0%

2nd Year

25%

3rd Year

30%

4th Year

38.33%

5th Year

45%

6th Year and above

55%

NCD Rates For Motorcycles

| 1st Year | 0% |

| 2nd Year | 15% |

| 3rd Year | 20% |

| 4th Year | 25% |

| 5th Year | 25% |

| 6th Year and above | 25% |

NCD Rates For Commercial Vehicles

| 1st Year | 0% |

| 2nd Year | 15% |

| 3rd Year | 20% |

| 4th Year | 25% |

| 5th Year | 25% |

| 6th Year and above | 25% |

Can NCD Expire?

NCD can not be expired but with time it can be decreased gradually. If you do not renew your car insurance your NCD rate decreases with the years you do not renew.

For example, if your NCD is 45% and you do not renew then next year your NCD will be 35%.

If you continue to not renew your vehicle insurance it will decrease every year and can reach 0%.

How we can Maintain NCD

We can maintain our NCD by avoiding making a claim whenever possible. However, there are some conditions in which NCD claim is not affected these are;

If the damage is manageable then it will be good for you to cover its costs because if you claim NCD for this this can affect your NCD.

Hence for claiming NCD, we should take care of these things so that our NCD can not be affected.

Can you Transfer NCD?

You can not pass your NCD to another person even if they are your family members. This restriction is because your NCD is tied to your IC number.

However, you can transfer your NCD to another vehicle you own for this you have to withdraw the claim for NCD for your old car.For this you have to remember that the vehicle type should be the same otherwise you can not transfer your NCD to a different type of vehicle.

Understanding Insurance Claims and Your No Claim Discount (NCD)

Your No Claim Discount (NCD) is a valuable reward for safe driving practices in many countries, including Malaysia. It translates to a discount on your car insurance premiums. However, not all claims will jeopardize your hard-earned NCD. Let’s dive into the types of claims that typically won’t reduce your discount:

Claims Where You Are Not At Fault

Specific Claim Types

Important Considerations

How to Protect Your NCD

Conclusion

In conclusion, we can understand that NCD is key for very important for vehicle users and if we utilize it we can take much benefit of that.

We can easily understand when we should claim NCD and when we should not so it does not affect our NCD rates.