Carbon Tax Malaysia

A carbon tax is a tax imposed on the emission of greenhouse gases, primarily carbon dioxide. Its purpose is to incentivize a reduction in these emissions and promote cleaner energy sources. Given Malaysia’s vulnerability to climate change and its current environmental challenges, implementing a carbon tax is a crucial step towards addressing these issues.

Malaysia’s geographical location and economic dependence on natural resources make it particularly susceptible to the impacts of climate change. Deforestation, pollution, and extreme weather events pose significant threats to its ecosystems and communities. Moreover, climate change can disrupt agriculture, tourism, and other sectors of the economy, leading to economic losses.

The country faces several environmental challenges, including deforestation for agricultural expansion and development projects, air and water pollution from industrial activities and transportation, and increasing frequency and intensity of extreme weather events such as floods, droughts, and heatwaves. These challenges not only impact the environment but also have adverse effects on public health and economic well-being.

Understanding Carbon Tax

A carbon tax is a tax imposed on the emission of greenhouse gases, primarily carbon dioxide. It serves as a market-based instrument to incentivize a reduction in these emissions, thereby mitigating the impacts of climate change.

How Carbon Tax Works

- Pricing Mechanism: Carbon taxes create a direct financial cost for emitting greenhouse gases. This cost is typically applied based on the amount of carbon dioxide emitted.

- Revenue Generation: The revenue collected from carbon taxes can be used in various ways, including:

- Investing in clean energy: Funds can be allocated to support research, development, and deployment of renewable energy technologies.

- Reducing tax burdens: Carbon tax revenue can be used to offset other taxes, potentially providing relief to businesses and households.

- Addressing climate change impacts: Funds can be directed towards adaptation measures to help communities cope with the effects of climate change, such as building infrastructure resilient to extreme weather events.

Potential Benefits of Carbon Tax

- Environmental Benefits:

- Reduction in greenhouse gas emissions: Carbon taxes create a strong economic incentive for businesses and individuals to adopt more energy-efficient practices and switch to cleaner energy sources.

- Improved air quality: By reducing emissions of pollutants, carbon taxes can contribute to cleaner air and better public health.

- Preservation of ecosystems: Carbon taxes can help protect ecosystems and biodiversity by reducing the impacts of climate change.

- Economic Benefits:

- Innovation and job creation: Carbon taxes can stimulate innovation in clean energy technologies, leading to new industries and job opportunities.

- Increased competitiveness: By leveling the playing field for businesses that adopt cleaner practices, carbon taxes can enhance the competitiveness of domestic industries in the global market.

- Social Benefits:

- Equity: Carbon taxes can be designed to ensure that the burden of the tax is distributed fairly, protecting vulnerable populations.

- Public health: By improving air quality and reducing the impacts of climate change, carbon taxes can contribute to better public health outcomes.

Malaysia’s Carbon Tax Landscape

Current Status of Carbon Tax Implementation

As of now, Malaysia has not yet implemented a nationwide carbon tax. However, there have been discussions and initiatives within the government to explore the feasibility and potential benefits of such a policy.

Government Policies and Initiatives

The Malaysian government has taken steps to address climate change through various policies and initiatives, including:

- National Energy Policy: This policy outlines the government’s goal to increase the share of renewable energy in the country’s energy mix.

- National Climate Change Policy: This policy provides a framework for Malaysia’s response to climate change, including adaptation and mitigation measures.

- Carbon Trading Scheme: The government has considered the implementation of a carbon trading scheme as a potential alternative or complement to a carbon tax.

Challenges and Obstacles to Carbon Tax Implementation

Several challenges and obstacles may hinder the implementation of a carbon tax in Malaysia:

- Economic Impact: Concerns about the potential negative economic impacts on industries and consumers may influence the government’s decision-making.

- Administrative Complexity: Implementing and administering a carbon tax can be complex, requiring robust monitoring and enforcement mechanisms.

- Political Will: Building consensus among stakeholders, including industry representatives, environmental groups, and government agencies, is essential for successful implementation.

Case Studies and Best Practices

International examples of successful carbon tax implementation can provide valuable insights for Malaysia:

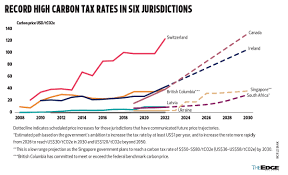

- Sweden: Sweden has one of the world’s highest carbon taxes, which has contributed to significant reductions in greenhouse gas emissions.

- UK: The UK’s Emissions Trading Scheme (ETS) has been effective in reducing emissions from certain sectors of the economy.

Lessons Learned and Potential Adaptations

Malaysia can learn from these case studies by:

- Phasing in the tax: Gradually increasing the carbon tax over time can help mitigate economic impacts and provide businesses with time to adjust.

- Revenue allocation: Carefully considering how carbon tax revenue is used can ensure that it is allocated to support climate-related initiatives and provide economic benefits.

- Addressing equity concerns: Designing the carbon tax to address equity issues, such as protecting vulnerable populations, is crucial for public acceptance.

Analysis of the Effectiveness of Carbon Tax in Achieving Climate Goals

While carbon taxes have shown promise in reducing greenhouse gas emissions in some countries, their effectiveness can vary depending on factors such as the level of the tax, the presence of complementary policies, and the overall economic context. It is important to conduct a thorough analysis of the potential effectiveness of a carbon tax in Malaysia before implementing it.

Potential Impacts of Carbon Tax in Malaysia

Economic Implications

- Industry Impacts: A carbon tax could have varying impacts on different industries in Malaysia. Energy-intensive sectors, such as manufacturing and transportation, may face higher costs due to increased carbon emissions. However, the tax could also incentivize these industries to adopt more energy-efficient technologies and practices.

- Job Creation or Loss: The overall impact on job creation or loss would depend on the specific design of the carbon tax and the effectiveness of government policies to mitigate negative economic effects. In the long run, the transition to a low-carbon economy could create new jobs in sectors such as renewable energy and energy efficiency.

Environmental Benefits

- Reduction in Greenhouse Gas Emissions: A carbon tax would provide a strong economic incentive for businesses and households to reduce their carbon emissions. This could lead to a significant decrease in greenhouse gas emissions, helping Malaysia to meet its climate change targets.

- Improved Air Quality: By reducing emissions of pollutants, a carbon tax could contribute to improved air quality, leading to better public health and reduced healthcare costs.

Social Effects

- Distributional Impacts: The impact of a carbon tax on different income groups would depend on the specific design of the tax. It is possible that low-income households may face a disproportionate burden, as they often spend a larger share of their income on energy. To address this, the government could implement measures to redistribute the revenue from the carbon tax or provide targeted assistance to vulnerable populations.

- Impacts on Vulnerable Populations: Vulnerable populations, such as those living in rural areas or those with limited access to resources, may be particularly affected by the impacts of climate change. A carbon tax can help to mitigate these impacts by promoting sustainable development and reducing greenhouse gas emissions. However, it is important to ensure that the tax is implemented in a way that does not exacerbate existing inequalities.

Recommendations and Future Outlook

Proposed Carbon Tax Structure and Pricing Mechanisms

A potential carbon tax structure for Malaysia could involve:

- Baseline emissions: Establishing a baseline for greenhouse gas emissions from various sectors to determine the taxable amount.

- Tax rate: Setting a carbon tax rate that is high enough to incentivize emissions reductions but not so high as to cause significant economic disruption.

- Exemptions: Considering exemptions or reduced tax rates for certain sectors or activities, such as small businesses or essential services.

- Revenue allocation: Determining how the revenue generated from the carbon tax will be used, such as investing in clean energy, reducing other taxes, or addressing climate change impacts.

Policy Recommendations for Effective Implementation

- Transparency and accountability: Ensuring transparency in the design and implementation of the carbon tax, including public consultation and access to information.

- Monitoring and enforcement: Establishing robust monitoring and enforcement mechanisms to ensure compliance with the carbon tax.

- International cooperation: Collaborating with other countries to develop harmonized carbon pricing policies and address international competitiveness concerns.

- Adaptation measures: Providing support for adaptation measures to help communities and businesses cope with the impacts of climate change.

Potential Challenges and Mitigation Strategies

- Economic impacts: Addressing concerns about the potential negative economic impacts on industries and consumers through targeted policies and support measures.

- Equity: Ensuring that the carbon tax is implemented in a way that addresses equity concerns and protects vulnerable populations.

- Political resistance: Building consensus among stakeholders and addressing potential political resistance to the carbon tax.

Future Directions for Carbon Pricing in Malaysia

- Carbon markets: Exploring the potential for a carbon market in Malaysia to complement or replace the carbon tax, allowing for more flexible emissions trading.

- Border carbon adjustments: Considering the implementation of border carbon adjustments to ensure that imported goods face a carbon tax equivalent to the domestic tax, promoting a level playing field for domestic industries.

Conclusion

A carbon tax offers a promising tool for addressing climate change in Malaysia. By placing a price on carbon emissions, it can incentivize businesses and households to adopt cleaner energy sources and reduce their environmental footprint. While there are potential challenges to implementation, careful consideration of the design and implementation of the tax can help to maximize its benefits and minimize its negative impacts.

Continued research and policy development in the area of carbon pricing are essential to ensure that Malaysia can effectively address the challenges of climate change and transition to a sustainable future.