Road Tax Calculator Malaysia

Owning a vehicle in Malaysia could be expensive. Thus, it’s become important to know about how to calculate road tax. Moreover, if you are planning to buy a car or motorcycle then you must know how much money you need to pay road tax. Road Tax Calculator is an easy-to-use tool to calculate Malaysia roadtax .

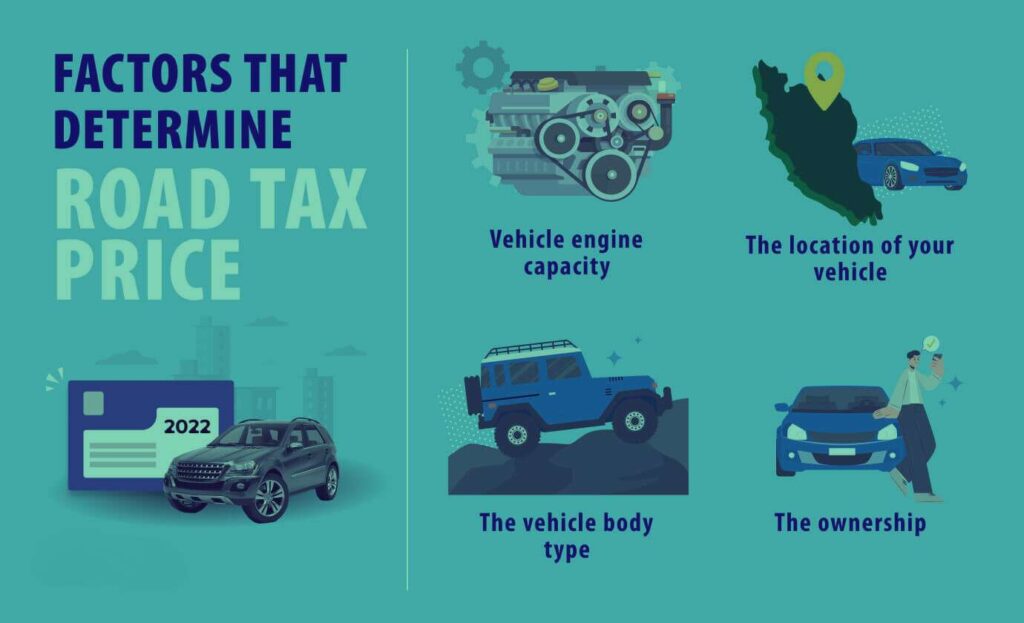

Road Tax is set by by the Road Transport Department Malaysia (Jabatan Pengangkutan Jalan or JPJ) based on a fixed formula. However, the amount paid depends on various factors.

We have broken down the list of factors that could helpful tools as JPJ Road tax calculator Malaysia.

What is Road Tax

According to the “Road Transport 1987 Act” road tax which is also officially known as Motor Vehicle License (LKM) will be implemented on all vehicles in Malaysia.

It is paid to the government of Malaysia and this money is to be deposited in a consolidated fund. This fund is used to build infrastructure and improve transportation services.

How is road tax calculated?

Road Tax Calculator Malaysia is the best tool for a non-technical person to calculate tool. However, you can calculate it manually too. Four main factors are used to calculate the Malaysia road tax. It has a unique style for calculating road tax.

Note: The rate of the cars is not determined by the car. They are determined by these factors. For Motorcycle, only two factors are determined engine capacity and location.

Engine Displacement/Capacity

The road tax cost you pay for your vehicle in Malaysia is linked to its engine capacity, which is measured in cubic centimeters (cc). Whether your vehicle runs on petrol or diesel doesn’t impact the road tax rate. The higher your engine capacity, the more will be your road tax.

TIP: A useful tip to estimate your vehicle’s capacity is to look at the number following the model name. For example, a Proton Saga 1.3 houses a 1300cc engine, while the Saga 1.6 boasts a 1600cc engine.

The basic rate for cars across all regions in Malaysia is RM20, whereas motorcycles start at a base rate of RM2. Moreover, prices progressively increase based on engine size. Fixed flat rates apply up to 1600cc for cars, ranging from RM20 to RM90. Beyond this threshold, progressive rates kick in.

Geographical Influence on Road Tax Rates

The geographical location of your vehicle also plays an important role in determining road tax. Generally, motorists in East Malaysia (Sabah & Sarawak) enjoy lower rates compared to their Peninsular Malaysia counterparts.

The challenging geographical conditions and less developed infrastructure in East Malaysia often mean narrower and rougher roads.

As a result, many residents opt for four-wheel-drive vehicles, which typically have higher engine capacities and maintenance costs. However, a more lenient road tax structure helps offset these expenses.

Conversely, duty-free zones like Pangkor, Langkawi, and Labuan boast even lower road tax rates. In these areas, cars with an engine displacement below 1000cc incur a fee of RM20.

For cars exceeding 1000cc, Langkawi and Pangkor residents pay about half the rates of Peninsular Malaysia, while Labuan boasts the lowest rates, with drivers paying only 50% of East Malaysia prices.

It’s essential to note that road tax is calculated based on the vehicle’s current location, not its registration location. For instance, a Sabah-registered car used in KL will be subject to West Malaysia’s rates.

Vehicle Body Type and Road Tax Classifications

In Malaysia, all cars fall into two categories: “saloons” or “non-saloons.” Saloons include sedans, hatchbacks, coupes, wagons, and convertibles.

Non-saloon vehicles comprise MPVs, SUVs, and pickup trucks, which attract a higher road tax base rate. However, for non-saloon vehicles, the rate can be cheaper than that for a saloon car with the same engine capacity after crossing a certain threshold.

It’s crucial to correctly identify your vehicle type when purchasing road tax to avoid miscalculations.

Ownership and Road Tax Rates

If your car is company-registered, it will incur higher road tax rates, but this is exclusive to saloon cars. Both private and company-registered vehicles pay the same rate as non-saloon cars.

How to use the Road Tax Calculator

Road Tax Calculator Malaysia is easy to use user-friendly tool. It is the most reliable tool and you can also use it as jpj roadtax calculator. Here is a breakdown of how you can use it.

Note: Roads tax Calculator depends on region vehicle running. Tax does not depend on the location vehicle registered

Road Tax Price List

Here is a breakdown list of rates of vehicles in different areas. You can easily use this tool as Car road tax calculator.

Car Tad in Peninsular Malaysia

Private Registered Saloon Cars in Peninsular Malaysia

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

|---|---|---|

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM55.00 | – |

| 1201 to 1400 | RM70.00 | – |

| 1401 to 1600 | RM90.00 | – |

| 1601 to 1800 | RM200.00 | RM0.40 (for every cc increase from 1600) |

| 1801 to 2000 | RM280.00 | RM0.50 (for every cc increase from 1800) |

| 2001 to 2500 | RM380.00 | RM1.00 (for every cc increase from 2000) |

| 2501 to 3000 | RM880.00 | RM2.50 (for every cc increase from 2500) |

| 3001 and above | RM2130.00 | RM4.50 (for every cc increase from 3000) |

Company Registered Saloon Cars in Peninsular Malaysia

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM110.00 | – |

| 1201 to 1400 | RM140.00 | – |

| 1401 to 1600 | RM180.00 | – |

| 1601 to 1800 | RM400.00 | RM0.80 (for every cc increase from 1600) |

| 1801 to 2000 | RM560.00 | RM1.00 (for every cc increase from 1800) |

| 2001 to 2500 | RM760.00 | RM3.00 (for every cc increase from 2000) |

| 2501 to 3000 | RM2260.00 | RM7.50 (for every cc increase from 2500) |

| 3001 and above | RM6010.00 | RM13.50 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars in Peninsular Malaysia

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM85.00 | – |

| 1201 to 1400 | RM100.00 | – |

| 1401 to 1600 | RM120.00 | – |

| 1601 to 1800 | RM300.00 | RM0.30 (for every cc increase from 1600) |

| 1801 to 2000 | RM360.00 | RM0.40 (for every cc increase from 1800) |

| 2001 to 2500 | RM440.00 | RM0.80 (for every cc increase from 2000) |

| 2501 to 3000 | RM840.00 | RM1.60 (for every cc increase from 2500) |

| 3001 and above | RM1640.00 | RM1.60 (for every cc increase from 3000) |

Road Tax Rates in Pulau Pangkor & Langkawi

Private Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| Less than 1000 | RM20.00 | – |

| 1001 to 1200 | RM27.50 | – |

| 1201 to 1400 | RM35.00 | – |

| 1401 to 1600 | RM45.00 | – |

| 1601 to 1800 | RM100.00 | RM0.20 (for every cc increase from 1600) |

| 1801 to 2000 | RM140.00 | RM0.25 (for every cc increase from 1800) |

| 2001 to 2500 | RM190.00 | RM0.50 (for every cc increase from 2000) |

| 2501 to 3000 | RM440.00 | RM0.75 (for every cc increase from 2500) |

| 3001 and above | RM1065.00 | RM0.25 (for every cc increase from 3000) |

Company Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| Less than 1000 | RM20.00 | – |

| 1001 to 1200 | RM55 | – |

| 1201 to 1400 | RM70.00 | – |

| 1401 to 1600 | RM90.00 | – |

| 1601 to 1800 | RM200.00 | RM0.40 (for every cc increase from 1600) |

| 1801 to 2000 | RM280.00 | RM0.50(for every cc increase from 1800) |

| 2001 to 2500 | RM381.00 | RM0.50 (for every cc increase from 2000) |

| 2501 to 3000 | RM1103.00 | RM0.75 (for every cc increase from 2500) |

| 3001 and above | RM3011.00 | RM0.75 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| Less than 1000 | RM20.00 | – |

| 1001 to 1200 | RM55.00 | – |

| 1201 to 1400 | RM70.00 | – |

| 1401 to 1600 | RM90.00 | – |

| 1601 to 1800 | RM200.00 | RM0.40 (for every cc increase from 1600) |

| 1801 to 2000 | RM280.00 | RM0.50 (for every cc increase from 1800) |

| 2001 to 2500 | RM381.00 | RM0.50 (for every cc increase from 2000) |

| 2501 to 3000 | RM1103.00 | RM0.75 (for every cc increase from 2500) |

| 3001 and above | RM3011.00 | RM0.75 (for every cc increase from 3000) |

Roadtax Rates in Sabah / Sarawak

Private Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM44.00 | – |

| 1201 to 1400 | RM56.00 | – |

| 1401 to 1600 | RM72.00 | – |

| 1601 to 1800 | RM1160.00 | RM0.32 (for every cc increase from 1600) |

| 1801 to 2000 | RM224.00 | RM0.25 (for every cc increase from 1800) |

| 2001 to 2500 | RM274.00 | RM0.50 (for every cc increase from 2000) |

| 2501 to 3000 | RM525.00 | RM0.00 (for every cc increase from 2500) |

| 3001 and above | RM1025.00 | RM0.35 (for every cc increase from 3000) |

Company Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM44.00 | – |

| 1201 to 1400 | RM56.00 | – |

| 1401 to 1600 | RM72.00 | – |

| 1601 to 1800 | RM160.00 | RM0.32 (for every cc increase from 1600) |

| 1801 to 2000 | RM224.00 | RM0.25 (for every cc increase from 1800) |

| 2001 to 2500 | RM274.00 | RM0.50 (for every cc increase from 2000) |

| 2501 to 3000 | RM225.00 | RM7.50 (for every cc increase from 2500) |

| 3001 and above | RM1025.00 | RM10.35 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM42.50 | – |

| 1201 to 1400 | RM50.00 | – |

| 1401 to 1600 | RM60.00 | – |

| 1601 to 1800 | RM165.00 | RM0.17 (for every cc increase from 1600) |

| 1801 to 2000 | RM199.00 | RM0.22 (for every cc increase from 1800) |

| 2001 to 2500 | RM243.00 | RM0.44 (for every cc increase from 2000) |

| 2501 to 3000 | RM463.00 | RM0.88 (for every cc increase from 2500) |

| 3001 and above | RM904.00 | RM0.20 (for every cc increase from 3000) |

Road Tax Rates in Labuan

Private Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM22.00 | – |

| 1201 to 1400 | RM28.00 | – |

| 1401 to 1600 | RM36.00 | – |

| 1601 to 1800 | RM80.00 | RM0.16 (for every cc increase from 1600) |

| 1801 to 2000 | RM112.00 | RM0.13 (for every cc increase from 1800) |

| 2001 to 2500 | RM137.00 | RM0.25 (for every cc increase from 2000) |

| 2501 to 3000 | RM262.00 | RM0.50 (for every cc increase from 2500) |

| 3001 and above | RM512.00 | RM0.68 (for every cc increase from 3000) |

Company Registered Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM22.00 | – |

| 1201 to 1400 | RM28.00 | – |

| 1401 to 1600 | RM36.00 | – |

| 1601 to 1800 | RM80.00 | RM0.16 (for every cc increase from 1600) |

| 1801 to 2000 | RM112.00 | RM0.13 (for every cc increase from 1800) |

| 2001 to 2500 | RM137.00 | RM0.25 (for every cc increase from 2000) |

| 2501 to 3000 | RM265.00 | RM0.50 (for every cc increase from 2500) |

| 3001 and above | RM512.00 | RM0.68 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars

| Cubic Capacity (cc) | Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | – |

| 1001 to 1200 | RM21.25 | – |

| 1201 to 1400 | RM25.00 | – |

| 1401 to 1600 | RM30.00 | – |

| 1601 to 1800 | RM82.00 | RM0.89 (for every cc increase from 1600) |

| 1801 to 2000 | RM99.00 | RM0.61 (for every cc increase from 1800) |

| 2001 to 2500 | RM121.00 | RM0.71 (for every cc increase from 2000) |

| 2501 to 3000 | RM231.00 | RM0.94 (for every cc increase from 2500) |

| 3001 and above | RM452.00 | RM0.10 (for every cc increase from 3000) |

Motorcycle Road Tax Calculator in Malaysia

People living in Malaysia have to pay motor roadtax. The price may vary from RM2-RM350 depending on the engine capacity (CC). You can use our road tax moto calculator for doing calculations.

Read More: Road Tax Motor

Car Road Tax Calculator Malaysia

Here, you’ll discover the road tax rates for various popular car models. To find your specific model quickly, you can use the browser search function (Ctrl + F) on this extensive list.

Pro Tip: If your vehicle isn’t on the list or if you want to calculate both your insurance premiums and road tax, make use of our insurance quote & road tax calculator.

Please note that the road tax prices mentioned are accurate as of the time of publication and are subject to change without prior notice. For any updates, refer to JPJ (Road Transport Department).

Read More: Senarai Harga Roadtax Kereta

Conclusions

We have explained all about road tax calculators in Malaysia. We have listed down factors on which road tax depends. You can use our tool to calculate road tax. It is very easy to use. Just put CC and select the location and ownership type of the vehicle. All information are according to the JPJ roadtax calcu.

It will give you results. Moreover, we have listed down all about road tax of each car, motorcycle, and car model. If you have any issues then let us know.